Seven years in, Village Capital co-founders Ross Baird and Victoria Fram write about how Village Capital has reimagined venture capital from the bottom up

In his best-selling book Originals, author Adam Grant describes how global theatrical phenomenon Cirque du Soleil determines which high-flying acts actually make it into a show.

The study’s author, Justin Berg, surveyed both Creators — circus performers who designed new feats — and Managers — the ringmasters who historically decided which acts would see the light of day. But were ringmasters really the best judges of which acts would be successful?

Berg found that Managers were often poor forecasters of which performances would be popular. They would choose new acts based on patterns of what the audiences liked last time — what we sometimes call “pattern recognition”. On the other hand, Creators were also poor forecasters of whether their own ideas would succeed: in general, humans have a cognitive bias that leads us to overestimate our own ideas and abilities relative to others’.

It turned out that the best evaluators of a Creator’s new idea were other Creators. With a finely tuned risk tolerance developed from years of their own failures, an understanding of how to make an impression on the audience, and a higher likelihood of respect for constructive, honest criticism from a fellow Creator, they were able to more effectively forecast the success of new performances.

Yet Creators are rarely in a position to decide which ideas get a shot.

Seven years ago, we launched Village Capital with the “Creator” in mind. After spending time in the traditional venture capital world (and learning from research by the Kauffman Foundation and others), we realized that the economics of investing in truly new ideas using the traditional venture capital process are, frankly, poor.

To re-invent the venture capital process, we would need to look to other innovative models for picking winners; models that had delivered results.

We were inspired by the “village banking” model that led to the growth of the microfinance industry. Microfinance has evolved into a multi-billion market of $100 handshake loans, with a global repayment rate of more than 99%. It scaled worldwide because of a process innovation: instead of traditional top-down lending, where a bank (‘Managers’) decides who is credit-worthy, the model brings together groups of entrepreneurs who self-organize (‘Creators’). Through a combination of transparency, peer pressure, and interpersonal relationships, the group decides who gets a loan. On the whole, villages have demonstrated they can be trusted to make great investments.

Ross first launched the idea in partnership with one of his most important mentors, Bob Pattillo, a serial entrepreneur and startup investor. We brought together entrepreneurs, surrounded them with peers all working on different ventures and added a twist: two founders in each cohort would get $100,000 in investment — as decided by their peers.

We heard both curiosity and skepticism. One mainstream investor told us, “This is going to be worse than Shark Tank. They’re going to rip each other apart — and these inexperienced entrepreneurs won’t even know what they’re talking about.” Another simply said we were “bonkers.” One blogger was so intrigued by the peer review concept that he wrote an article describing the model “as if angel investing and microfinance had a baby.”

Following the success of those initial pilots, we have raised more than $20M in investment capital for peer selection, and made more than 70 investments in four regions of the world — all picked by peer entrepreneurs.

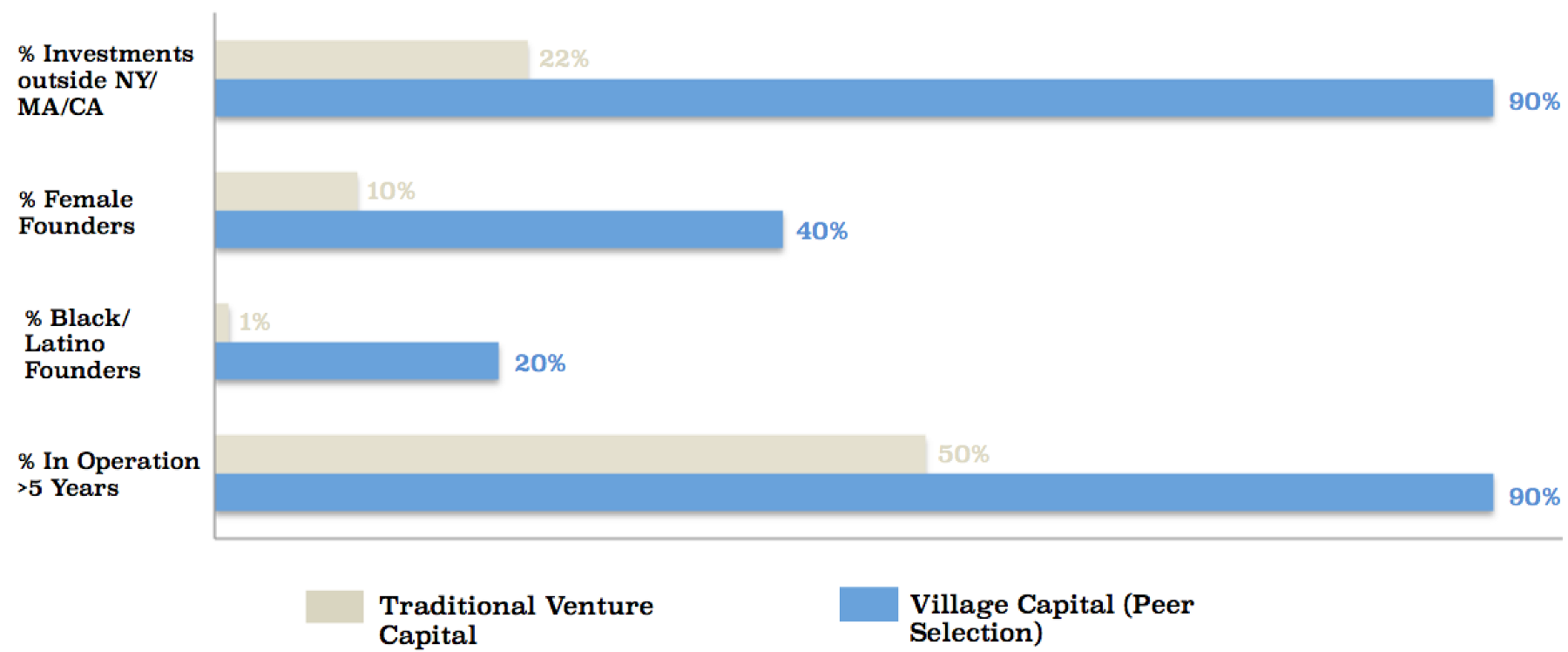

And we’re seeing very different results than the venture capital process. Our companies are more diverse — geographically and demographically — and more resilient than the traditional venture capital portfolio.

Why are entrepreneurs better forecasters of new ideas?

As we reflect from our first seven years at Village Capital, we’ve learned three lessons from peer selection that can help any investor be more successful.

1. Forecasting beats assessment.

Going back to the circus analogy, we can’t assume that professional investors are automatically good forecasters of ideas. This assertion is extensively backed up in Justin Berg’s research — and the research of other scientists, such as Bill Tetlock, who wrote the best-selling book Superforecasters (also see Erik Dane of Rice University, who has written extensively about how expertise may actually block the best new ideas by coalescing around existing patterns; Wharton’s Laura Huang, who studieshow individual backgrounds, perceptions, and preferences often bias decisions in new investments; or Gerd Gigerenzer of the Max Planck Institute of Berlin, who studies when “fast and frugal” heuristics work — and when they don’t.)

An overarching theme among these thinkers is that experts tend to be good at assessing — identifying what has worked — but are often poor at forecasting — identifying what will work. Kodak famously developed the digital camera internally — and decided it wouldn’t work. Microsoft was sure that the iPhone would not get significant market share. When I’m investing in a new idea, old patterns likely don’t matter.

2. All investment decisions have unconscious bias — it’s better to be honest about it.

Just because professional investors have bias doesn’t mean fellow entrepreneurs don’t. We’ve run more than 50 programs with the peer review process — and in addition to our ongoing programs, through this year’s VilCap Communities initiative, we have 26 third-party incubators/accelerators and venture funds piloting the Village Capital process so we can learn more about what works, and what doesn’t, when entrepreneurs themselves make investment decisions outside of our purview.

In our early pilots, the process was very unstructured — and done by secret ballot. We had each founder rank their peers in order, with no fixed criteria. Sometimes, it worked out great. Other times, it was a popularity contest (“I really love Greg — she’s so great”) or a “sympathy vote” (“Sam, god bless him, is such a great guy. If we don’t invest in him, no one else will.”)

Over time, we have iterated on the process to make it transparent and structured. Teams evaluate each other on potential and return on investment across criteria — with a focus on forecasting. Teams are also transparent — if I rank you well or poorly, the entire peer group can see the results. The average founder gets almost no feedback from the circus of business plan competitions and pitches to venture fund investment committees — but gets company-changing feedback from their peers. And instead of a small group of people secretly making decisions — applying their unconscious biases — a large group of people transparently say what they like and why.

The peer review methodology is not something we invented. In addition to microfinance’s “village bank,” academia has utilized peer review for centuries. Silicon Valley venture capital firms often employ entrepreneurs for sourcing and diligence. Creators have long played a role in the forecasting of new ideas — we just don’t always notice.

The lesson: being open and transparent about the biases that influence our decisions improves the diversity of ideas that get a shot — and the results of the investment.

The front pages of the paper this year have been dominated by Brexit and the election of Donald Trump — and while the causes for both are complicated, one thing is clear: in a fast-moving economy, most people are feeling left out. This is an existential threat to our stability as a global society.

Backing entrepreneurs with new ideas can counter this disturbing trend — nearly 100% of net new jobs created over the past thirty years are from new businesses. Yet right now, new firm creation is highly concentrated: firm creation in the U.S. is at a 30-year low, and outside of the wealthiest cities, more firms are dying every day than are starting.

But there’s a problem. The blocking and tackling of top-down, Manager-led investment makes supporting new ideas using the venture capital model difficult. Fund managers are under serious pressure to deploy millions of dollars in a relatively short period of time, so it’s no wonder that people invest in people nearby, who they went to school with, in networks they understand.

Using a Manager-led model, it’s very difficult to scale investment in new ideas outside of one’s immediate comfort zone in a localized, contextualized way. Managers are expensive, and if you want to invest in, say, Des Moines or Nashville, but your capital is in New York or San Francisco, it’s very hard to make the transfer work.

What we’ve found through Village Capital is that peer selection is not only more effective at choosing new ideas; it’s also more scalable. Managers don’t have to do diligence on hundreds of companies; instead Creators — who already have the market and sector context — can fast-track to conducting in-depth analysis of each other’s businesses, with the advantage of social capital built as equals. We have focused on core industries that affect the lives of people every day: health, education, energy, agriculture, financial services, and we’ve focused on communities with strengths in those areas.

The cultural narrative of the venture capital process — find a few heroic entrepreneurs, and create the next “unicorn” — a billion-dollar company — doesn’t work for most founders or investors, and it certainly doesn’t work for society. Peer selection creates a different and better cultural narrative.

The idea of peer selection was — and still is — somewhat disruptive to the venture capital industry. Many still make the argument that entrepreneurs don’t have the training, experience, or expertise necessary to reliably identify the most promising innovations that are ready for investment, nor do they know how to accurately assess the value of each other’s companies.

This criticism, we think, is true for ideas with a substantial track record. Later stage venture capital and private equity investors deploying tens of millions of dollars in growth capital have years of evidence of a company’s performance, and are making decisions based on assessing a company’s growth trajectory, rather than predicting whether an idea and its early execution will be successful.

When evaluating new ideas, though, we need to get past the idea that entrepreneurs and investors are on “opposite sides of the table”. Many venture investors tout their firms as “founder-friendly” or “founder-first”. We can’t think of a more deliberate way to show we’re founder-first than to actually give founders the power to determine how we invest.

What can you learn from our past seven years? If you’re in a position to pick which ideas see the light of day — if you can give time, money, or power to a new idea — you are in a position to change the trajectory of your company, your community, and the world. Yet for all the time and money we as a society spend on what new ideas we’ll back, we spend very little effort re-thinking how we’ll select new ideas. Instead of a top-down business plan competition or evaluation process, consider a bottom-up peer-selection process — where the Creators closest to the problem forecast which solution will be best.

And where are we going in the next seven years and beyond? If you’re a great entrepreneur with a new idea, we’d love to welcome you to the community of hundreds of inspiring founders we’ve put first. If you want to partner with us to have entrepreneurs drive the ideas that will improve your industry or community, we’ve worked with hundreds of great partners over the past seven years and would love to collaborate with you. And if you buy the peer selection thesis — we’d love to see how we can invest together. Drop us a line at our website, and let’s explore what’s next.

Our newsletters share the latest about our programs, trends, ecosystem leaders, and innovative entrepreneurs in the impact world. Get the latest insights, right in your inbox by subscribing:

Village Capital needs the contact information you provide to us to contact you about our products and services. You may unsubscribe from these communications at any time. For information on how to unsubscribe, as well as our privacy practices and commitment to protecting your privacy, please review our Privacy Policy.