The entrepreneur smiled and raised her hand. It had just dawned on Rupa Chandra Gupta why some investors had been telling her “not yet” when she pitched her ed-tech company, Sown to Grow.

Update to: ‘Why Most Entrepreneurs Hate Fundraising — And How to Fix It’

On the ledger-sized grid in front of her, she had drawn stars around a few boxes in a row labeled “Hitting Product-Market Fit,” and she wanted to share the moment of realization with her peers. Were a majority of sales in the target market inbound? Have we validated strong unit economics in our business model?

She had often spoken about achieving product market fit, but her mental milestones were significantly different from the descriptions on the page. THIS may be the source of misalignment and confusion in investor conversations.

Now she had a roadmap. Rupa was excited to take the marked-up assessment back to her team at Sown to Grow, so they could prioritize what to focus on next. How might they address the product-market fit milestones, and what others did they think were critical?

On her way out, she asked for a few more paper copies of the grid.

Now there’s no need to request paper copies. We’re excited to announce the launch of Abaca, which makes the assessment available as a web app, so that entrepreneurs everywhere can have that moment of understanding and find the capital and resources they need.

Entrepreneurs, meet Abaca!

Rupa is one of more than 1,000 entrepreneurs in 30 countries who have come away from Village Capital’s investment readiness assessment (known as VIRAL for those who have been through it), with a new understanding of how investors might view their companies — and a better sense of what next steps they need to prioritize to have a better shot at accessing the capital they need to scale.

A few years ago, Village Capital’s co-founder, Ross Baird, posted “Why Most Entrepreneurs Hate Fundraising — And How to Fix It,” about the lack of a common language between entrepreneurs and investors, and the frustration and wasted time rooted in mismatched expectations.

That’s the problem we set out to address with Abaca. Abaca gives entrepreneurs the opportunity to assess their business from the lens of an investor, thereby better equipping them to approach the right kind of investor with a better understanding of their company’s strengths and weaknesses. That saves time and frustration on both sides.

<blockquote class="twitter-tweet"><p lang="en" dir="ltr">Looking forward to helping entrepreneurs and investors have better funding conversations using <a href="https://twitter.com/villagecapital?ref_src=twsrc%5Etfw">@VillageCapital</a>'s VIRAL Pathway at this morning's <a href="https://twitter.com/SEED_Conf?ref_src=twsrc%5Etfw">@SEED_Conf</a> <a href="https://twitter.com/ImpactHubSF?ref_src=twsrc%5Etfw">@ImpactHubSF</a> <a href="https://twitter.com/hashtag/impactinvesting?src=hash&ref_src=twsrc%5Etfw">#impactinvesting</a> <a href="https://twitter.com/hashtag/startups?src=hash&ref_src=twsrc%5Etfw">#startups</a> <a href="https://twitter.com/hashtag/vc?src=hash&ref_src=twsrc%5Etfw">#vc</a></p>— Peter Lundquist (@peterlundquist) <a href="https://twitter.com/peterlundquist/status/987348407009226752?ref_src=twsrc%5Etfw">April 20, 2018</a></blockquote> <script async src="https://platform.twitter.com/widgets.js" charset="utf-8"></script>

Entrepreneurs can go to abaca.app to benchmark their company’s investment readiness, and then share the results with investors, mentors, co-founders and other supporters.

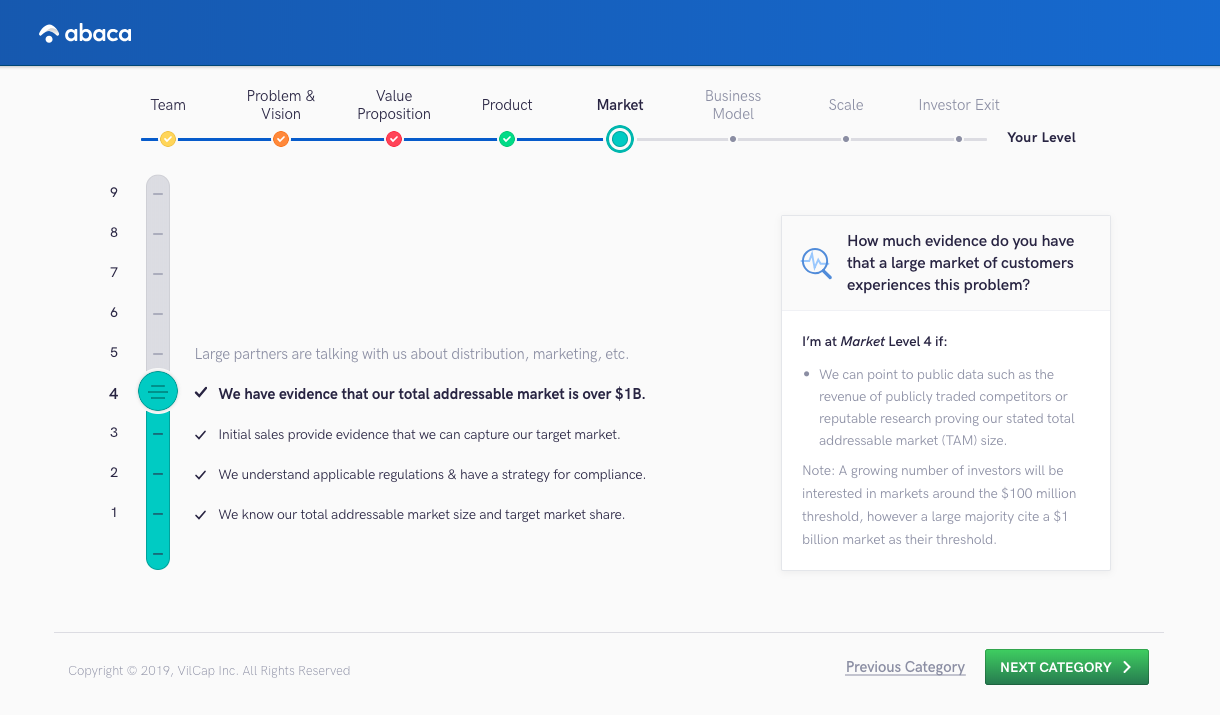

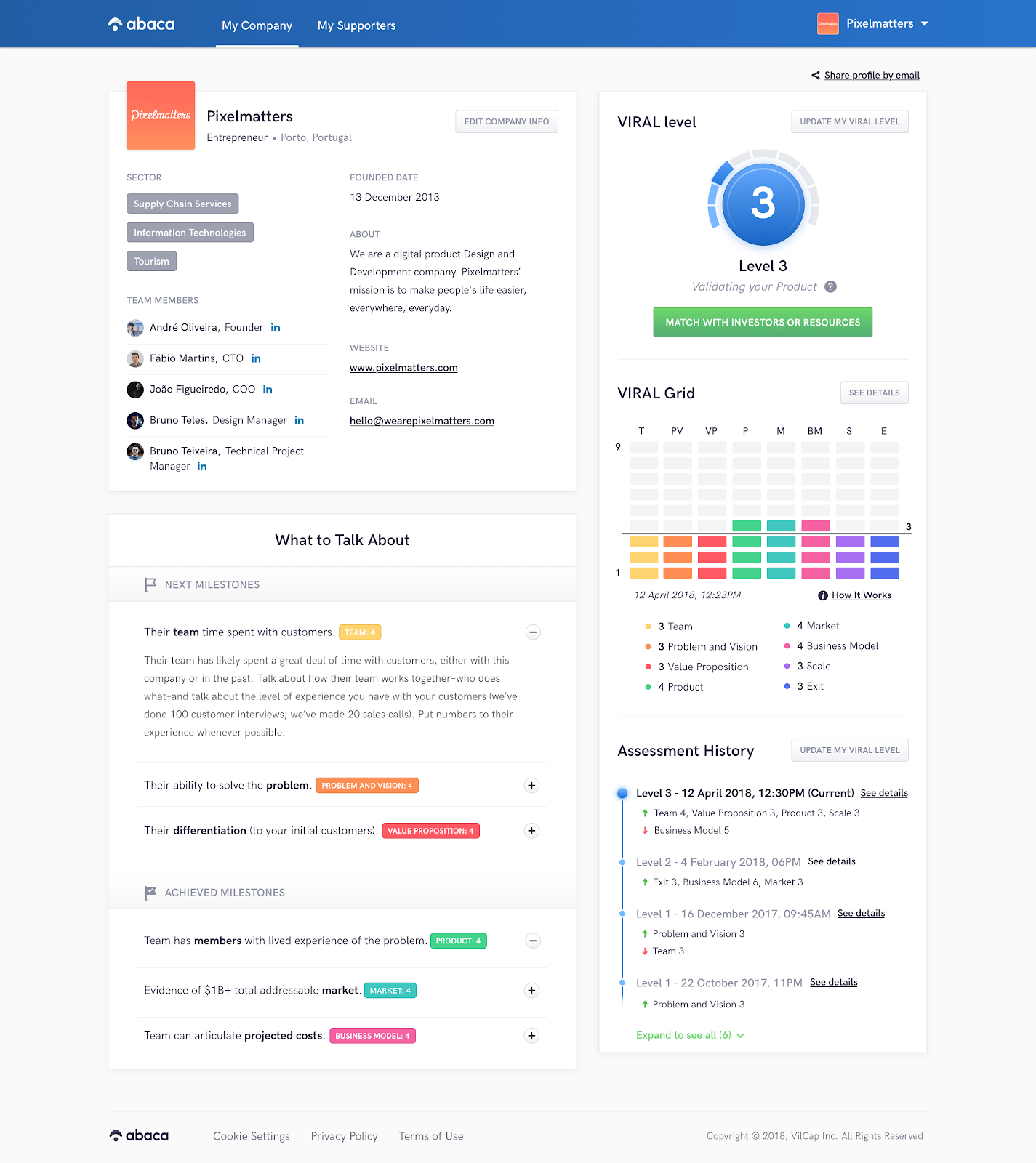

The benchmark takes the form of a Venture Investment Level, from 1 to 9, and a set of milestones — such as the Market Level 4 milestone Gupta identified — which together give a clearer understanding of where a company is on its path to scale.

Each assessment is stored within a shareable company profile, including the assessment history for tracking progress visually over time.

Also included in this release is the first pass at a matching feature, where entrepreneurs can find sources of funding as well as non-monetary resources that fit their level, geography, sector and traction.

So far, we have seeded the matching database with investors and resources we’ve worked with, including more than 100 from across the Commonwealth of Virginia, who were part of a pilot project.

There’s more to come there — our next priority is to expand the matching capabilities and network, including by providing a self-service interface for investors and resources to set up and fine-tune their matching criteria.

By providing a common language, Abaca also aims to knock down barriers to capital for entrepreneurs, who come from backgrounds, places and networks outside the traditional purview of most venture capital investors.

Many investors receive so many unsolicited contacts, they revert to shortcuts like warm introductions or pattern matching within a small pool of founders, creating blind spots for entrepreneurs outside of that pool. Village Capital initially created VIRAL as part of its mission to “democratize entrepreneurship”, and change the fact that the venture capital dollars overwhelmingly flow to networks of wealthy, white men in three U.S. states: California, New York and Massachusetts.

Abaca can help investors find great founders, ideas and deals outside of their immediate networks. It’s been a key component of our groundbreaking Peer-Selected Investment model, which research shows is helping mitigate bias against female entrepreneurs — and we’re excited to get even more people on the platform.

We are incredibly grateful to the partners who have supported the development of Abaca: Sorenson Impact Foundation, Blue Haven Initiative, The Collis/Warner Foundation, Virginia is for Entrepreneurs: VA4E, and DOEN Foundation. Thank you for your support.

And a big thumbs-up emoji to our design and development partners, Pixelmatters. Keep an eye out for a making-of story that will include more about our work with the Pixelmatters team, based in Porto, Portugal.

Peter Lundquist is Head of Product at Village Capital and is leading the team responsible for the creation of Abaca and a growing line-up of tools and products aimed at building the field of entrepreneur support.

Andrew Hobbs is Abaca’s Product Manager. Andrew works closely with founders and investors to understand what problems Abaca could address and then turns the vision into reality. He’s now focused on Abaca’s Value Proposition, Level 5 milestone: “Our initial target customers love the product and keep using it.”

Our newsletters share the latest about our programs, trends, ecosystem leaders, and innovative entrepreneurs in the impact world. Get the latest insights, right in your inbox by subscribing:

Village Capital needs the contact information you provide to us to contact you about our products and services. You may unsubscribe from these communications at any time. For information on how to unsubscribe, as well as our privacy practices and commitment to protecting your privacy, please review our Privacy Policy.