2020! The opening of a new decade coincides with the beginning of a new decade in the Village Capital story.

Last year our fund, VilCap Investments, made its 110th and final initial seed investment, and shifted its focus to supporting our existing portfolio, doubling down on the most promising companies addressing financial health, affordable healthcare, innovations in the future of work, sustainable food and agriculture systems, and clean energy solutions for a changing climate.

So we asked ourselves: what comes next?

Over the past few years we’ve been expanding how we approach our mission: to reinvent the system to back the entrepreneurs of the future. We started licensing our curriculum, and now more than 50 VilCap Communities around the world run programs with elements of peer-selected investment. We launched Abaca, an online matching tool to more effectively connect investors and entrepreneurs that already has more than 3,000 users. We have moved toward a new, broader vision for Village Capital, as a platform to support impact-driven entrepreneurs at scale.

Connecting companies with investment capital will remain a key lynchpin of that vision — and so we’re excited today to announce that Village Capital is rolling out a “family of funds” strategy: a series of funds focused on investing in seed-stage, impact-driven startups through a variety of different vehicles. The funds will invest in startups that are involved with Village Capital - through our accelerator programs, Abaca, or otherwise.

As we kick off this new strategy, we’re excited to announce the first vehicle in the family of funds: a program-related investments (PRI) fund in partnership with MetLife Foundation, focused on direct investments in early-stage startups that are helping low and middle income consumers and small businesses improve their financial health.

Why a family of funds? Form matching function

Based on the strong results we’ve seen in our portfolio to date, the traditional next step for our team would have been to raise another, larger mainly-equity-based fund that looks just like the first. But our mission is to reinvent the system. Doing what we’ve done before is not who we are. Here’s why we have decided to pursue a family of funds instead.

First, the family of funds model will allow us to explore targeted funds that focus on specific sectors and geographies, rather than forcing investments into a “one-size-fits-all” strategy. Our team at Village Capital regularly works with entrepreneurs on four continents (26 countries overall), and entrepreneurs in different places have different needs. An agtech entrepreneur in Nairobi has a different path to scale and accessing funding than a fintech founder in Detroit.

.jpg?width=992&name=FamilyofFunds-horizontal-new%20(1).jpg)

Second, the model will allow us to continue to experiment with innovative capital structures. It’s common knowledge that access to capital is highly uneven, and part of the reason is that traditional capital structures (equity and debt) don’t work for the vast majority of startups. We have already invested via alternative structures like revenue share agreements, and want to continue to build investment vehicles to support more alternative strategies. (Read more in our report, Capital Evolving).

Third, this model will allow us to scale our reach and help be a force multiplier for early stage capital. Over the past decade we’ve worked with dozens of corporate and foundation partners that have expressed interest in deploying their own capital in service of impact-driven, early stage entrepreneurs. Our first fund with MetLife Foundation is one example of how we can partner with institutions to find and invest in high-potential, high-impact startups.

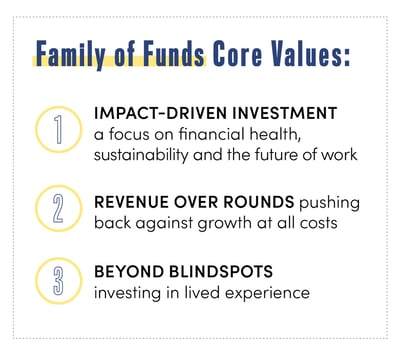

A set of core values

As we build out this family of funds, we’ll be guided by a core set of values:

• Impact-Driven Investment — After ten years working with 1,100 startups addressing everything from sustainable farming to mobile payments, we’ve identified three sectors we believe present the most significant opportunity for impact at the early-stage today, and will build on our track record supporting them. We’re excited about startups working on financial health, the future of work, and sustainability.

• Impact-Driven Investment — After ten years working with 1,100 startups addressing everything from sustainable farming to mobile payments, we’ve identified three sectors we believe present the most significant opportunity for impact at the early-stage today, and will build on our track record supporting them. We’re excited about startups working on financial health, the future of work, and sustainability.

• Revenue over Rounds — The growing backlash against a “growth-at-all-costs” mentality has cast attention back to the need for strong business fundamentals. Since our first investment in 2009, the median seed deal has more than quadrupled to $2.1 million. We’re excited about startups that value customers and sales growth over inflated valuations, and that want to realistically forecast how much capital they need and a liquidity timeline that encourages healthy growth.

• Beyond Blindspots — Diversity in tech has attracted much more conversation over the last 10 years, but funding for startups led by women and people of color remains unacceptably low, and capital remains concentrated in the hands of entrepreneurs in New York, Massachusetts and California. We’re excited to continue pursuing the competitive advantage that we believe comes with investing inclusively.

A partnership with MetLife Foundation

We have had a productive partnership with MetLife Foundation for several years now, most recently with the launch of Finance Forward, a global coalition created with MetLife Foundation, PayPal, and local partners to support 100+ early-stage entrepreneurs working on financial health on five continents.

We’re excited to build on this partnership with this new investment vehicle. We will manage the lifecycle of MetLife Foundation’s investments in financial health-focused startups. Throughout, we’ll collaborate with MetLife Foundation staff to ensure shared learning and to enhance their internal capacity for investing at the early stage.

This fund will match the values of our family of funds: Impact-Driven Investment (financial health is one of the sectors that we have identified as having the greatest potential for impact); Revenues over Rounds (the fund will explore patient and alternative capital approaches where appropriate); and Beyond Blindspots (we will maintain our core value of supporting entrepreneurs who have lived experience with the problem they are solving). Learn more about the MetLife Foundation PRI fund here.

If you’re interested in learning more about our family of funds, reach out to us at allieb@vilcap.com and victoria@vilcapinvestments.com.

Our newsletters share the latest about our programs, trends, ecosystem leaders, and innovative entrepreneurs in the impact world. Get the latest insights, right in your inbox by subscribing:

Village Capital needs the contact information you provide to us to contact you about our products and services. You may unsubscribe from these communications at any time. For information on how to unsubscribe, as well as our privacy practices and commitment to protecting your privacy, please review our Privacy Policy.