This interview is part of a series about innovative startups in Village Capital's network that are responding creatively to the challenges raised by COVID-19.

More than 350,000 people in Mexico have lost jobs in the past month because of the coronavirus epidemic, and many more have seen their hours cut as the economy slows down. This has accelerated the problem of predatory lending in Mexican cities, as workers rely on pawn shops or the informal economy to make ends meet.

ePesos helps workers deal with variability in income and manage their expenses on a weekly basis. They work with employers to create a credit line for employees – the employee can get a cash advance and pay their employer back when the pay cycle closes.

We spoke with founder and CEO Óscar Robles about how demand for their product has grown in the past month:

On informal lenders:

Lending is incredibly complex in Latin America. As of 2019, less than 50 percent of Latin Americans had a formal credit score. As a result, banks often require more collateral, more paperwork, and high interest rates to get a loan, making them inaccessible to average people.

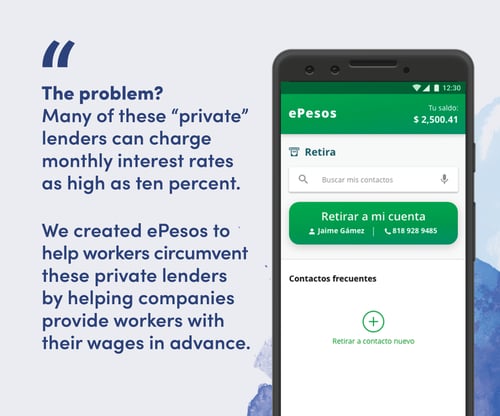

With no other option to turn to, people resort to payday lenders and pawnshops to provide them with quick cash. The problem? Many of these “private” lenders can charge monthly interest rates as high as ten percent. We created ePesos to help workers circumvent these private lenders by helping companies provide workers with their wages in advance.

With no other option to turn to, people resort to payday lenders and pawnshops to provide them with quick cash. The problem? Many of these “private” lenders can charge monthly interest rates as high as ten percent. We created ePesos to help workers circumvent these private lenders by helping companies provide workers with their wages in advance.

On the effect of coronavirus:

We sell our product to businesses, and the pandemic has only shone a brighter light on what we have seen since 2018: business owners want to take care of their employees, especially in times of crisis.

If workers don’t feel that their employer cares about them and is invested in them, they will simply look elsewhere for work. The past few weeks have seen higher levels of turnover in the Mexican labor market, as employees whose hours have been cut go find work wherever they can. Businesses that use our platform have reported employees staying with them for twice as long.

ePesos also helps employers avoid the toxic environment that is created with informal lending. A lot of time, there is informal lending between middle managers and lower-ranking employees. This means an employee might have a working relationship with your boss, and also a credit relationship. By gaining access to their wages at any time, workers no longer have to worry about mixing work and finances.

Our newsletters share the latest about our programs, trends, ecosystem leaders, and innovative entrepreneurs in the impact world. Get the latest insights, right in your inbox by subscribing:

Village Capital needs the contact information you provide to us to contact you about our products and services. You may unsubscribe from these communications at any time. For information on how to unsubscribe, as well as our privacy practices and commitment to protecting your privacy, please review our Privacy Policy.