‘The challenge is -- as so many of you know -- it’s very often hard to take those first steps. It’s hard to access capital. It’s hard sometimes to get the training and the skills to run a business as professionally as it needs to be in this competitive world. It’s hard to tap into the networks and mentors that can mean the difference between a venture taking off and one that falls flat.’

- Barack Obama, GES 2015, Nairobi, Kenya

Africa has the youngest population in the world: 60% of the continent's population is under the age of 25, and 10-12 million young Africans join the workforce every year. The bulk of these young people become entrepreneurs in one way or another as a necessity, due to lack of reliable employment opportunities.

Over the past decade we’ve seen a significant increase in the number of "ecosystem-building" organisations that are moving into the space of supporting entrepreneurs - incubators, accelerators and seed funds. However, little has been done to support these organisations, which often need help just much as the entrepreneurs they are helping.

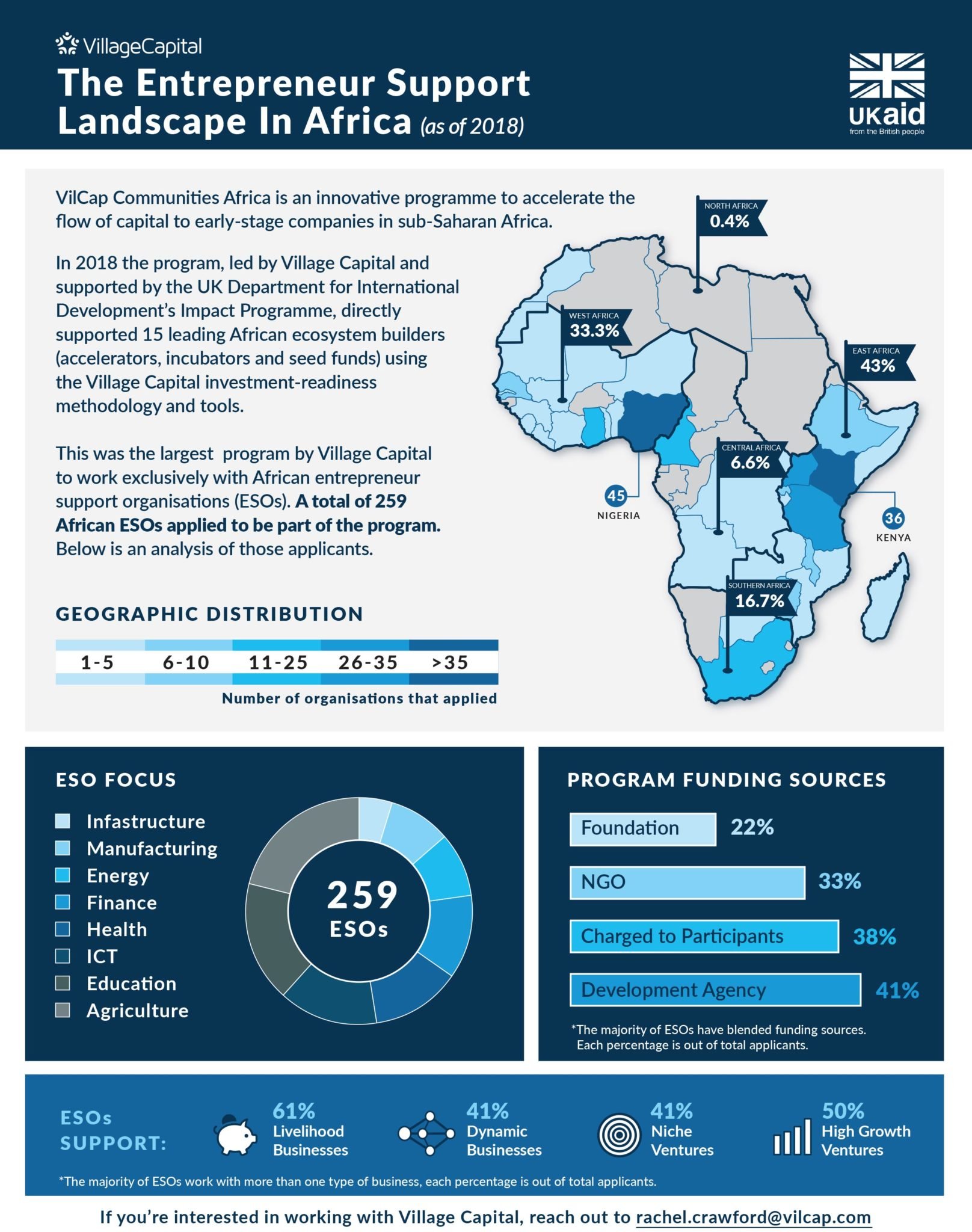

It was in this context that Village Capital and the UK Department for International Development (DFID) Impact Programme launched VilCap Communities Africa, a programme to equip African entrepreneur ecosystem organisations with the tools, resources and connections they need to catalyze impact investment. We received 259 applications for the program, from ESOs across 33 African countries.

We've used data from those 259 applications to put together a snapshot of the entrepreneur support landscape in Sub-Saharan Africa:

Applicants ranged from the most developed economies in sub-Saharan Africa (such as Nigeria, Kenya, South Africa) to to the most nascent ecosystems (such as Togo, Malawi and Mali). The bulk of the applications came from East Africa and West Africa. Seventeen percent came from Francophone Africa. We were able to pull four takeaways from the data:

We will be releasing our full findings from the program in our upcoming VCC Africa Insights Report. If you would like to receive a notification once it is released, please sign up here.

Our newsletters share the latest about our programs, trends, ecosystem leaders, and innovative entrepreneurs in the impact world. Get the latest insights, right in your inbox by subscribing:

Village Capital needs the contact information you provide to us to contact you about our products and services. You may unsubscribe from these communications at any time. For information on how to unsubscribe, as well as our privacy practices and commitment to protecting your privacy, please review our Privacy Policy.