People often use the phrase, “Talent is everywhere, but opportunity is not.” I might take this one step further and say that talent is everywhere, but power is not.

Power has become increasingly concentrated in a few people and places in our society. A report from Oxfam showed that 82% of the wealth created last year went to the top 1% of people.

In the world of venture capital, the biggest decisions are often made in skyscrapers in New York City and San Francisco. Those decisions flow down to have a major effect on where money (and power) flows across the world.

There’s a learned helplessness here: we tend to assume that people at the top of the skyscraper are best qualified, or have the best perspective, to provide the best advice or make the best investment decisions. But data keeps coming out to refute this idea.

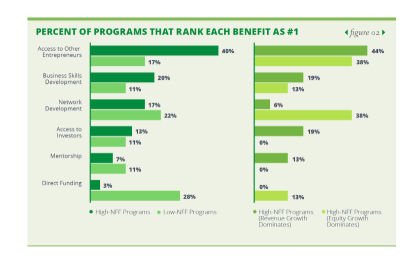

This month the Global Accelerator Learning Initiative (GALI) released their latest batch of data in the world’s biggest study of entrepreneur accelerators. The study, which includes data from 550 Village Capital alumni, found that the highest-performing accelerators tend to emphasize “access to other entrepreneurs” as the number one benefit of the program.

In other words, accelerators that value peer collaboration tend to outperform the rest.

Peer collaboration and peer review have always been at the center of Village Capital’s work. We believe entrepreneurs are better judges of new ideas than “expert” investors, and we’ve facilitated more than 90 investments where the final decision about where to allocate capital was made by entrepreneurs.

This summer we will be conducting a full, in-depth study of the peer-selected investment process, to find out how to maximize the impact of entrepreneurs’ relationships with each other. One thing that won’t change is the fundamental belief that we need to change the power dynamics of traditional venture capital if we want to change the outcomes.

Entrepreneurs are not just “acted upon” by investors at Village Capital programs - they act.

The final ten hours of a Village Capital investment program might be the most important. By the time we reach those final hours, the founders in the program have already shared countless hours, sessions and experiences with each other - debating about business models and acquisition strategies, offering each other frank advice, and learning how their fellow founders respond to constructive criticism.

On the final day, everyone gathers behind closed doors for the Hot Seat, a final session where each founder takes turns getting peppered with tough questions by their peers. Immediately afterward, each founder retires to her room (or to a quiet corner of the conference center) to put on their “investor hat” and assess each of their peers according to several investment criteria, resulting in a ranking of each company in the cohort. The two companies ranked as “most ready for investment” will receive offers of seed capital from our affiliated fund, VilCap Investments.

This process - which we call peer-selected investment - has always been a core piece of Village Capital’s work to reinvent early stage investing. It’s helped VilCap Investments reach its goal of a diverse, high performing portfolio (42% of our portfolio companies have a female founder or co-founder, and 30% of our US companies have a Black or Latinx founder or co-founder, far exceeding the typical venture capital fund, and we’ve already seen 13 exits to date). This summer we’re going to be asking ourselves tough questions about how we can improve it.

Like the GALI team, we’re data nerds. We were GALI’s first big partner back in 2015, when we gave them all our data. It was not a risk-free decision. We wanted to know if peer-review was working. That decision has paid off again and again. This month’s report included data on more than 550 of our alumni, and we’ve been able to iterate on our process with each new batch of data.

This summer, we’re taking this data and going a step further to evaluate the performance data from more than 1,000 of the ventures that have applied to Village Capital’s programs. We’ll be taking data from GALI (and Emory University’s Entrepreneur Database Program) and combining it with detailed internal data from our own selection and peer-evaluation processes. This integrated database will help us answer a few keys questions, like: does relying on entrepreneurs to make investment decisions lead to a more inclusive and higher performing investment portfolio?

At the end of the study—conducted in partnership with a research team based out of the Social Enterprise @ Goizueta program at Emory—we will share our findings in the fall to continue a conversation about how the insights from this process can inform the industry at large.

We know that talent is everywhere, but power is not. We’ll keep researching alternative investment strategies with the ultimate goal to catalyze more capital into high potential entrepreneurs that are solving real world problems.

Our newsletters share the latest about our programs, trends, ecosystem leaders, and innovative entrepreneurs in the impact world. Get the latest insights, right in your inbox by subscribing:

Village Capital needs the contact information you provide to us to contact you about our products and services. You may unsubscribe from these communications at any time. For information on how to unsubscribe, as well as our privacy practices and commitment to protecting your privacy, please review our Privacy Policy.