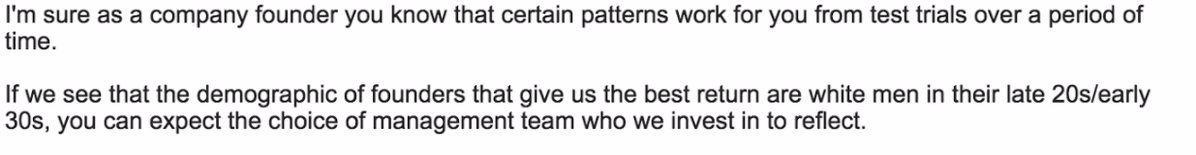

Up close:

Now, we’d like to acknowledge that we don’t know who this investor is, and we don’t have the context of the rest of the email. If the investor who wrote this would like to respond to this blog, we’re all ears.

But it sure seems like this investor is saying out loud what most investors only imply: We’d rather invest in white founders.

![]()